Last Updated: June 8, 2022

The following Merchandise Terms and Conditions apply only to the sale and/or delivery by you, as Vendor, of Products for resale by Refuel Operating Company (the “Company”) to the end consumer. These Merchandise Terms and Conditions apply in addition to the General Terms and Conditions applicable to all Company Vendors. The attached Price Book, Payables and Receiving Guidelines and UPC Requirements, as the same may be amended or modified from time to time by written notice from the Company, are a part of—and are incorporated by reference into—these Merchandise Terms and Conditions, which are part of your Vendor Packet with the Company. These Merchandise Terms and Conditions may be updated may be updated by us from time to time without notice to you.

Vendor hereby represents and warrants to Company as follows:

1. on the date of delivery, the Products will be in good and merchantable condition and fit for use for the purposes intended and in compliance with the requirements of the Food and Drug Administration’s Good Manufacturing Practices, and any applicable federal, state and local laws including those that govern the manufacture, composition, adulteration, packaging, labeling, sale and security of foods or foodstuffs. Vendor’s warranty under this Section 3(a) includes compliance with the (1) Federal Food, Drug and Cosmetic Act, as amended, including the Food Additives Amendment of 1958 and the Nutrition Labeling and Education Act of 1990 (the “FDA Act”); (2) Federal Fair Packaging and Labeling Act; (3) Federal Insecticide, Fungicide, and Rodenticide Act; (4) Federal Hazardous Substances Act; (5) Public Health Security and Bioterrorism Preparedness and Response Act of 2002; (6) the Consumer Products Act, as amended and (7) any regulations promulgated pursuant to the foregoing

2. it will not use any ingredients in the production of the Products that have been subjected to irradiation processes;

3. the Products will not contain ingredients wholly or partially composed of materials produced by genetic modification or recombinant DNA technology or containing materials derived from ingredients thus produced;

4. it has and will have, at all times relevant hereto, equipment and production capacity necessary to produce the Products in accordance with agreed to Product forecasts and accepted purchase orders;

5. that (A) the finished packaged Products at the time they leave Vendor’s possession will not be adulterated or misbranded within the meaning of the FDA Act or excluded from interstate commerce under the provisions of Sections 404, 503 or 512 of the FDA Act; (B) any color additive contained in the Products at the time they leave Vendor’s possession will be from a batch certified by Vendor or its supplier if certification is required under the FDA Act; and (C) the finished packaged Products will be manufactured in compliance with both (1) Title VII of the Civil Rights Act of 1964 and, if applicable, Executive Order No. 11246, each as amended, and (2) the Fair Labor Standards Act of 1938, as amended (the “FLS Act”), including the regulations and orders of the Administrator of the Wage and Hour Division issued under Section 14 of the FLS Act as follows. Upon request by Company at any time, Vendor will include the following certification on each invoice accompanying the delivery of each shipment of Products produced under this Agreement:

“We hereby certify that these goods were produced in compliance with all applicable requirements of Sections 6, 7, and 12 of the Fair Labor Standards Act, as amended, and of regulations and orders of the United States Department of Labor issued under Section 14 thereof;” and

6. that Vendor’s performance under this Agreement shall be in material compliance with all other applicable laws, rules, orders, regulations and requirements of any foreign, federal, state, city, county or other local government, including, without limitation, the equal employment opportunity laws, workers’ compensation insurance requirements, the Occupational Safety and Health Act of 1970, as amended (“OSHA”), and any law, statute, ordinance, rule, regulation, order, determination, restrictive covenant or deed restriction which regulates the use, generation, disposal, release, storage or presence on Vendor’s facilities of substances that are corrosive, toxic, carcinogenic, radioactive, environmentally hazardous or that have similar characteristics (including specifically, but without limitation, the Comprehensive Environmental Response, Compensation, and Liability Act of 1980 (“CERCLA”), and the Recourse Conservation and Recovery Act of 1976 (“RCRA”). Further, Vendor shall promptly provide notification of and forward to Company any orders, complaints, warnings, notices or summonses received by Vendor relating to its lack of compliance with any of the foregoing in connection with its performance under this

All representations and stipulations required by the FLS Act and regulations issued by the Secretary of Labor (41 C.F.R. Chapter 50) are incorporated by reference. These representations and stipulations are subject to all applicable rulings and interpretations by the Secretary of Labor that are now, or may hereafter, be in effect. Vendor further warrants that all employees whose work relates to any Products will be paid not less than the minimum wage prescribed by regulations issued by the Secretary of Labor (41 C.F.R. 50-202.2), unless specifically provided elsewhere under Section 14 of the FLS Act.

In the event the Company and Vendor mutually agree it is necessary to recall from the Company System any quantity of the Products for any reason including, but not limited to issue bearing on its quality and/or safety, Vendor agrees to comply diligently with all recall procedures established from time to time by the Company. Furthermore, Vendor agrees to bear all costs and expenses incurred by it and/or the Company in complying with such recall using any means or means specified by the Company or any other statutory authority or which subsequently fails to meet acceptable standards. In the event Vendor disagrees with the Company’s determination that a recall is necessary and therefore fails or refuses to comply with the recall requested hereunder by the Company, the Company shall be authorized to take such action as it deems necessary to complete the recall from the Company Locations. The Vendor shall be liable for such recall to the extent that such recall resulted from Vendor’s failure to deliver Products that meet either specific or customary specifications and standards. If the Company does not perform the recall because of Vendor’s failure to comply, then any and all liabilities arising from or related to the act of not recalling shall be the sole responsibility of Vendor to the extent such recall resulted from a breach by Vendor of applicable specifications, and Vendor shall reimburse the Company for its costs and expenses incurred in such recall procedures, to the extent such recall resulted from a breach by Vendor of applicable expectations. (Any such action taken by the Company shall not relieve Vendor of its obligations hereunder.)

Vendor understands and agrees that any marks, trademarks, design, trade dress, or other indicia of intellectual property (collectively, “Marks”) specific to any private label or proprietary Products developed by or for Company and produced, manufactured and/or distributed by Vendor for Company shall remain the sole and exclusive property of Company. Vendor understands and acknowledges that its manufacture, delivery and/or supply of any such Products shall not be deemed to assign, convey or grant Vendor any license or other interest in any Mark(s) (other than the right to manufacture and package Products bearing the Mark(s), in accordance with the terms of a purchase order or requisition request specifying Product design and quantity).

Price Book price is payment price. In the event that, prior to the Company’s final receipt of goods under any order, Vendor sells (or offers to sell) goods at lower prices and/or on terms more favorable to any third party that are substantially of the same kind as the goods ordered by Company, the prices and/or terms offered to Company shall be deemed automatically revised to equal the lowest prices and most favorable terms at which Seller shall have sold (or shall have offered to sell) such goods to a third party and payment shall be made accordingly.

In the event the Company shall become entitled to such lower prices but shall have made payment at any prices in excess thereof, Vendor shall promptly refund the difference in price to the Company. Vendor agrees to meet the price of legitimate competition. Vendor shall allow for post audits and such claims as found as a result of post audit. The prices to the Company set forth in any invoice shall include all excise taxes. Vendor’s invoice must indicate either, as separate line item or in memorandum form, the amount of excise tax included and to which taxing authority paid. It is the responsibility of the Vendor to notify the Company when any new item purchased by the Company is subject to an excise tax and payable by the Company directly to a taxing authority. Failure of the Vendor to advise the Company of the taxability of a new item will result in the Vendor assuming the tax liability. If any manufacturer’s excise or other taxes are paid on the goods described in an invoice and such tax or any part thereof is refunded to the Vendor, then Vendor shall immediately pay the Company the amount of such refund. In the event that a court or regulatory agency or body finds that the prices on an invoice are in excess of that allowed by any law or regulation of any governmental agency, the prices shall be automatically revised to equal a price which is not in violation of said law or regulations. If the Company shall have made payment before it is determined that there has been a violation, Vendor shall promptly refund an amount of money equal to the difference between the price paid for the goods and price which is not a violation of said regulations. Product shorted on orders on promotion, guaranteed pricing, should be given the same pricing, deals, or allowances on the invoice(s) shipped after the product was shorted totaling the quantities shorted.

1. Price Increases/Decreases

The Company requires at least thirty (30) days written notice prior to any price increase or decrease. Customer contract pricing and commodity items (commodities are items that have fluctuating values) will be allowed ten (10) days notification.

Notices regarding price increase or decrease must be submitted ONLY on items carried by the Company and must be submitted on appropriate Company price change sheets. The Company reserves the right to assess penalties for pricing information submitted

in the incorrect format or on items not carried by the Company.

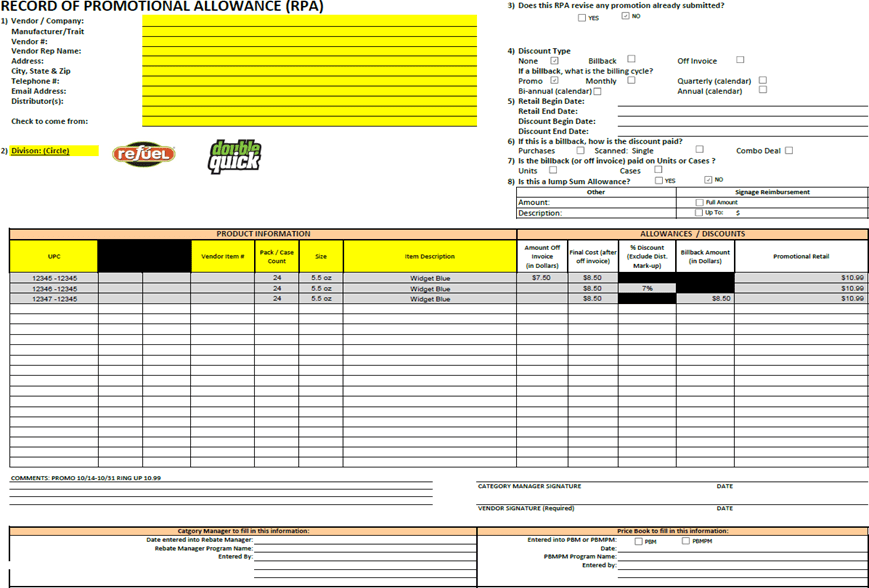

2. Deal, Promotions, or Rebate Notifications

If the Company is not notified in writing thirty (30) days prior to start date of any deal, promotion, rebate or price decrease, the Company will still be entitled to the benefits of the deal window.

The Company will evaluate Vendor’s performance on a regular basis and will meet with Vendor to review that evaluation as described in each part of this Agreement.

Invoice payment of all monies subject to this Agreement and inquiries MUST BE MAILED TO THE COMPANY’S ACCOUNTS PAYABLE DEPARTMENT AT THE ADDRESS INDICATED BELOW. Invoices or inquiries mailed to anyone or any department other than Accounts Payable shall not be deemed to be received or valid.

Mailing Address:

Refuel Operating Company, LLC

547 Long Point Road, Suites 102-103

Mt Pleasant, South Carolina 29464

Attention: Accounting

Credits/Returns

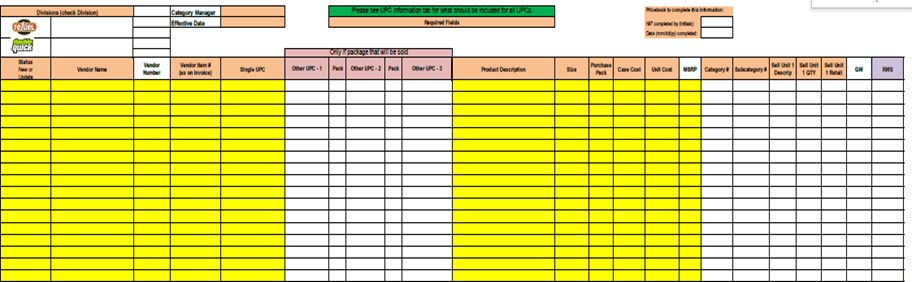

Receiving New Merchandise